Kyrgyzstan: Strengthening the Anti-Money Laundering Regime

Bishkek, Kyrgyzstan

Kyrgyzstan is a small Central Asian country that is vulnerable to money laundering (ML) and drug traffic-related financial flows coming from Afghanistan. As a result, a number of large international banks have cut their correspondent accounts with Kyrgyz banks. This phenomenon, known as “de-risking”, has severed Kyrgyzstan’s linkages to the global financial system, and has damaged the ability of the Kyrgyz economy to make trade-related and other payments, and to receive remittances.

At the invitation of the High Technology Park of the Kyrgyz Economy and the U.S. Embassy in Bishkek, on July 27, FSVC Managing Director Chad Kilbourne gave a webinar to public and private Kyrgyz financial institutions on how to implement effective anti-money laundering (AML) regimes that meet international standards. Topics covered included how to adopt a risk-based approach to supervision and compliance, and how low-cost IT solutions can facilitate the work of compliance officers, supervisors and investigators to strengthen the AML chain.

Participants included the Central Bank of Kyrgyzstan, the Financial Intelligence Unit and the Kyrgyz Banking Association, and all three expressed great interest in the webinar, as they reported the severe impact of de-risking on their economy. COVID-19 has dramatically interrupted remittance flows and damaged many emerging economies, exposing more than ever the need for those countries to develop strong financial institutions and practices that meet international standards.

Niger: Launching a Second Civil Society Incubator

Civil society representatives during an FSVC Open-Door session. Zinder, Niger, August 2020

Since July 2019, with funding from the U.S. Agency for International Development (USAID), FSVC has been implementing the SHIGA program in Niger to strengthen political accountability and policymaking, as well as foster stronger civil society engagement. To build the capacity of civil society organizations (CSOs), FSVC runs CSO incubators to provide technical assistance to select CSOs, and create more connections and coalitions among incubated CSOs.

After successfully launching a CSO incubator in the capital city, Niamey, FSVC is now preparing to launch a second incubator in Zinder, the third largest city in Niger. To that end, in August, FSVC organized several Open-Door sessions in Zinder to present the SHIGA program and incubator to local CSOs. The event was very well received, with near 50 CSO representatives attending the sessions. Next, FSVC will launch a call for applications and select CSOs to participate in the first incubation cycle in Zinder.

Niger has been in the news this August after an attack that killed 8 people, reflecting a profound need for stronger citizen engagement and inclusiveness. In this tragic context, FSVC has become more committed than ever to its mission in the country.

#FSVC30thAnniversary: Building Critical Expertise in Anti-Money Laundering and

Combating the Financing of Terrorism

FSVC is celebrating its 30th anniversary this year! We are taking this opportunity to look back at the organization’s in-depth experience in anti-money laundering and combating the financing of terrorism (AML/CFT) in emerging market countries over the years.

FSVC began to tackle the global challenge of AML/CFT after the tragic events of September 11, 2001. This attack, as well as other dramatic terrorist attacks that took place in the early 2000s around the globe, reflected unstable underlying economic conditions and provided an urgent context for FSVC’s work in this area. Reflecting these concerns, FSVC’s first work on AML/CFT took place in Russia, Ukraine, the Philippines, Morocco, and other countries throughout the Middle East and Southeast Asia. FSVC helped strengthen the AML/CFT regimes in these countries on both the public and private sector sides, and was able to achieve key results hand-in-hand with counterparts. In the Philippines, for example, FSVC built the capacity of the Revenue Integrity Protection Service to detect, investigate and prosecute ML and corruption cases. As a result of FSVC’s technical assistance, two prominent military officials who committed ML and grafting were prosecuted. In Morocco, bank supervisors adopted international standards to conduct risk assessments and strengthened their information sharing with other North African jurisdictions, thanks to FSVC’s support.

During the following years, FSVC continued to expand its AML/CFT programs, notably in Indonesia, Malawi, Kenya and Jordan. FSVC helped operationalize the newly created Financial Intelligence Unit (FIU) in Malawi. In East Africa, FSVC worked with FIUs, law enforcement and the private sector in Kenya, Tanzania and Uganda to strengthen the AML/CFT financial chain. Key results included an increase in suspicious transactions report filings; improved capacity of FIUs to adopt a risk-based approach to AML/CFT supervision; and the signing of Memoranda of Understanding to facilitate information-sharing among domestic government agencies and on a regional basis. In Jordan and Dubai, FSVC helped regulators, law enforcement and the judiciary detect and investigate suspicious activity and prosecute ML and terrorist financing (TF) cases. FSVC provided tools to conduct investigations, and strengthened AML coordination and data-sharing among regulators, law enforcement and prosecutors.

Building on its extensive global experience and lessons learned, FSVC continues today to work with public and private sector institutions around the world to ensure that relevant stakeholders have the capacity and incentive to meet international standards in AML/CFT. In Somalia, since 2015 with support from the U.S. Department of State’s Bureau of Counterterrorism, FSVC has been working with the Central Bank and local financial institutions (banks, money transfer businesses) to improve their AML supervision and compliance, respectively, and facilitate public-private interaction on AML/CFT issues. In Tajikistan, FSVC is currently implementing a U.S. Embassy-funded program to strengthen the capacity of the FIU and the private sector to detect and report suspicious transactions. In Angola, FSVC is providing technical assistance to the Central Bank and the Banking Association to help the country address weaknesses identified by the Financial Action Task Force (FATF), and ultimately help re-build connections with the international financial system.

“AML/CFT is my favorite topic”, reported Danyelle Gerges, FSVC Regional Director for the Middle East. “At FSVC, we really keep up with the evolution in the field; for example, we now focus more and more on the use of FinTech to combat ML/TF. One of my most memorable projects took place a few years ago in Jordan. We trained regulators, investigators and intelligence officials in social media monitoring to combat ML/TF. Participants were so interested in the project that they could not stop asking questions, and they kept in touch with the volunteer experts long after the end of the activity to ask them how to implement tools to track social media. The relevance and impact of our work is really rewarding”.

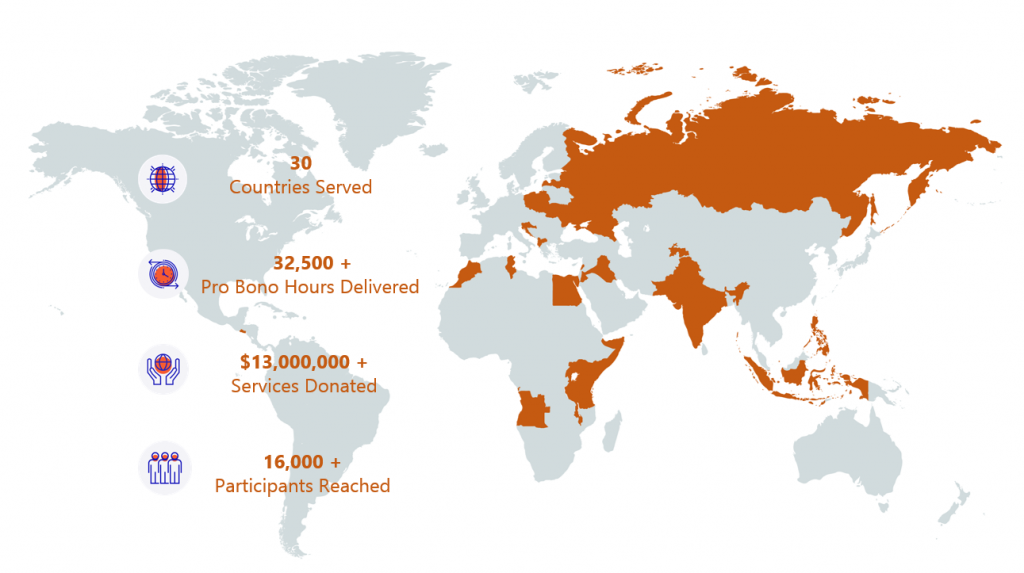

Over the years, FSVC has implemented programs to strengthen AML/CFT in 30 countries and provided over $13,000,000 in donated services. FSVC remains dedicated to continue its mission in this crucially important area.

Central America: Call for Spanish Speaking Volunteers!

Women in a market place. Chichicastenango, Guatemala

FSVC is expanding its program activity in Central America! As we are preparing to launch new programs on various financial topics, including budget transparency, public financial management and AML, we welcome applications from senior-level volunteer experts who could deliver activities in Spanish.

If you are interested in remote and/or in-country volunteering opportunities with FSVC in Central America, please reach out to us at volunteer@fsvc.org. We look forward to hearing from you!